The Promise of Cell and Gene Therapies: Overcoming Commercialization Challenges through Collaboration and Innovation

Cell and gene therapies (CGTs) have evolved from a theoretical approach into one of the most important innovations of our time, offering the unprecedented potential to treat—and, in some cases, cure—a growing number of serious diseases. Their ability to address the root causes of diseases at the genetic or cellular level, many of which have historically had limited or no other treatment options, is reshaping the treatment landscape across a wide range of conditions.

In oncology, for example, chimeric antigen receptor (CAR) T-cell therapies have reshaped the treatment landscape for several forms of blood cancer, including lymphomas, leukemia, and multiple myeloma, expanding options for patients. CGTs have also led to new standards of care in severe rare diseases. Children with spinal muscular atrophy, who typically would not survive past the age of 2, now have the potential to reach typical developmental milestones with a one-time treatment of gene therapy Zolgensma.1 Likewise, 2 gene therapies—Vertex’s Casgevy and Bluebird Bio’s Lyfengia—have demonstrated the ability to modify sickle cell disease and eliminate episodes of pain.2 Jimi Olaghere, a patient with sickle cell disease who was infused with Casgevy, famously climbed the summit of Mount Kilimanjaro 4 years after treatment.3

Clinicians are also optimistic about the potential impact CGTs can have on the lives of patients. As published in InspiroGene’s 2024 Cell and Gene Therapy Report, a survey of 124 US oncologists found that 99% agreed that CGTs are among the most important medical innovations of our time. Additionally, 97% expressed optimism about their potential benefits for patients, including the possibility of a cure.4

With dozens of CGTs on the market and thousands more in development, the potential to impact millions of people may be within reach. However, the path from scientific breakthrough to patient access is lined with challenges. Developing and commercializing these therapies requires complex and personalized processes, including specialized infrastructure, transportation, and administration. These factors, combined with high upfront costs, mean that CGTs do not fit neatly into the current health care value chain.

As the development pipeline expands with new CGTs to address conditions that impact increasingly larger patient populations—such as cardiovascular disease, autoimmune diseases, diabetes, and neurological disorders—the ability to address these barriers will become more essential, thus ensuring that these lifesaving therapies can reach the patients who need them.

CGTs are Primed for a Major Paradigm Shift

Up until this point, CGTs have largely been approved for cancers and rare diseases with relatively small patient populations. However, based on their ability to offer improved outcomes over existing medicines, many biopharmaceutical companies are racing to expand research and development into more prevalent disease categories.

To understand the pending paradigm shift facing CGTs, we must first explore the growth trajectory of these innovative therapies. Between 2018 and 2022, the US Food and Drug Administration (FDA) approved only 5 CGTs. This was followed by 5 FDA approvals in 2023 and 9 approvals in 2024 (excluding the expanded approval of Casgevy). The Alliance for Regenerative Medicine predicts that 60 to 70 CGTs could be approved globally by 2030.5

However, the real paradigm shift goes beyond an explosive growth in the number of approved CGT therapies; it lies within the projected growth in the number of patients who will be impacted by these innovative therapies within the next decade. An estimated 95 000 new patients will be treated with CGTs in 2025. By 2034, the number of patients in the US who are expected to have received CGTs is predicted to grow tenfold, reaching 1 million.6

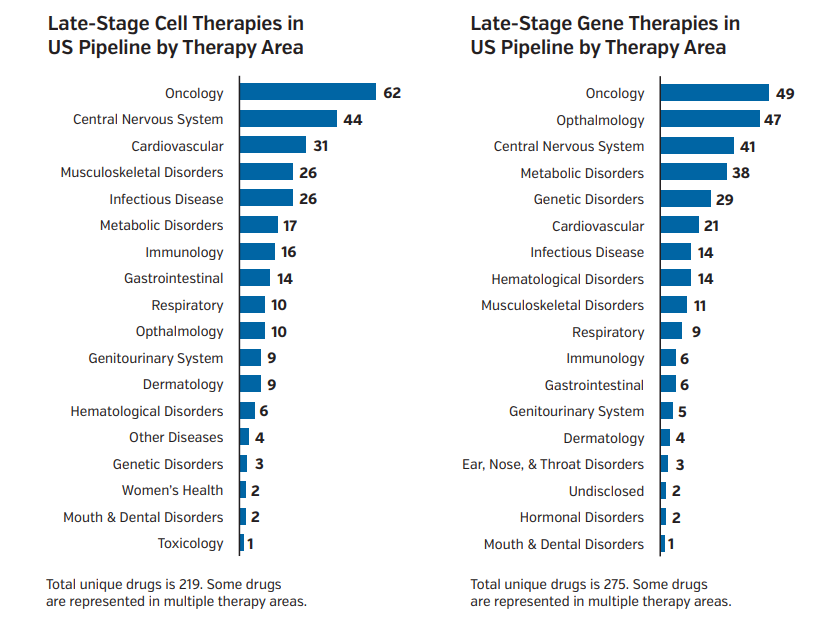

A quick look at the more than 700 CGTs in the late-stage US pipeline5 reveals that many target neurological, cardiovascular, and metabolic conditions, which impact much larger patient populations. For example, Abbvie and RegenxBio are currently developing a CGT that targets wet age-related macular degeneration (AMD), a disease that impacts 5.7 million patients worldwide.7 BlueRock Therapeutics and Bayer are developing a CGT that targets Parkinson disease, potentially reaching 10 million patients globally,8 and Vertex and Sana Biotechnology are developing a CGT that could help an estimated 3.8 million patients with type 1 diabetes.9

Figure 1. Late-Stage Cell and Gene Therapies in the US Pipeline

Therapies for neurological, cardiovascular, and metabolic conditions represent a growing portion of the CGT pipeline.

Abbreviation: CGT, cell and gene therapy.

Given the global burden of neurological and cardiovascular diseases alone—leading causes of disability and death worldwide—CGTs targeting these conditions have the potential to transform public health. As a result, CGTs may reshape how health care systems allocate resources, manage chronic disease, and think about treatment costs.

Individual patients, their families, the health care industry, and society as a whole stand to benefit significantly from this paradigm shift. That’s why the time is now for all stakeholders in the health care value chain to identify and remove barriers that stand in the way of patient access.

Complex Barriers Limit the Full Potential of CGTs

For the full potential of CGTs to be realized, the health care industry must address the complex obstacles to expanding real-world patient access.

Barrier 1: Growing the CGT pipeline requires more capacity. The complexity of manufacturing CGTs contributes to capacity challenges. For example, with autologous therapies, the manufacturing of each dose requires each patient’s cells to be collected, modified, and reintroduced back into the body. This sophisticated process requires specialized equipment and patient proximity to apheresis centers. The estimated growth rate for the number of apheresis centers lags far behind the expected increase in patient volume.10 CGTs also usually require specialized, often expensive, cold storage and transportation. Professionals need training and experience to manage the ultra-cold conditions, sometimes as low as –150°C, and complex chain-of-custody tracking.11

Another capacity challenge is the need for specialized training. CGTs often require complex treatment regimens, which entail specialized training for physicians, nurses, and hospital staff to facilitate. In InspiroGene's survey, expanded training for clinical staff was the most commonly cited solution for increasing CGT capacity at community cares sites and academic medical centers (AMCs).4 This includes not only the labor for performing apheresis, but also post-collection handling and coordination with processing labs.10 Additionally, training programs and certifications for handling CGT-related equipment can involve significant costs.4

These capacity challenges are only one component of the planning, investment, and infrastructure development needed to expand CGT access to the millions of patients who could benefit from them.

Barrier 2: Care is concentrated in large AMCs. Currently, approved CGTs are mostly available at large AMCs concentrated in major metropolitan areas, leaving millions of patients hours away from the nearest qualified treatment center.4

Approximately 60 million Americans live in rural areas with limited access to qualified CGT treatment centers.12 In InspiroGene’s aforementioned survey of 124 oncologists, 64% agreed that CGTs are not easily accessible for patients who meet the labeled indication.4 Additionally, research found that the likelihood of receiving a CAR T-cell therapy decreased by 40% when patients lived 2 to 4 hours from their nearest treatment center.13

To access CGTs, patients in these “CGT deserts” often need to travel the country, put their lives on hold, and leave support systems behind. The out-of-pocket costs of traveling for care can be prohibitive for many patients.

Figure 2. CGT Treatment Centers

Each dot represents a region or metropolitan area with one or more qualified CGT treatment centers.

Abbreviation: CGT, cell and gene therapy.

A potential solution to shrink these deserts is moving care to community hospitals and providers, but this approach brings its own challenges. Sites of care must undergo lengthy certification processes, hire and train specialized staff, and manage onboarding processes for each CGT they provide. Managing these costs is especially difficult for community hospitals and providers without the required infrastructure and with limited resources.

Barrier 3: CGTs require new, innovative methods of payment. CGTs have the potential to deliver extraordinary outcomes for patients. However, in addition to being complex to manufacture and transport, they are often delivered as a one-time treatment, and costs can range from $400 000 to $4 million.14

Managing the high upfront cost of CGTs remains a serious challenge in a health care system designed for pay-as-you-go therapies for chronic conditions. Additionally, the resources required vary between AMCs and community hospitals, further complicating CGT payment structures. Addressing this challenge will require both innovation and collaboration across the ecosystem, not just the industry.

Over the past decade, health care stakeholders—including manufacturers, payers, and policymakers—have explored the use of outcomes-based payment models to help reduce the financial risks associated with these therapies. Some biopharmaceutical manufacturers are experimenting with value-based payment plans that take patient response into account, as well as other models that spread the costs of therapy over time or implement risk-sharing agreements with payers.

Several states and federal agencies are also investigating value- and outcomes-based agreements, along with models to mitigate the burdens that accompany CGT treatments, including transportation, lodging, and follow-up visits.15

The payment landscape is evolving as stakeholders seek solutions to balance the cost of these transformative therapies with their long-term benefits. The work must continue to fine-tune payment models that meet the needs of all stakeholders across the continuum of care.

Collaboration is Key to Realize the Promise of CGTs

CGTs hold promise for long-term relief and, in some cases, cures for diseases historically considered chronic and unmanageable. However, an all-hands-on-deck, collaborative approach will be key to strengthening the infrastructure and payment models that will ensure widespread access to these therapies.

The next installments in this series will take a deeper dive into each of these barriers and how we can work together to bridge the gap between CGTs and the patients who need them.

References

- FDA approves innovative gene therapy to treat pediatric patients with spinal muscular atrophy, a rare disease and leading genetic cause of infant mortality. News release. FDA. Published May 14, 2019. Accessed February 28, 2025.

- FDA approves first gene therapy to treat patients with sickle cell disease. News release. FDA. December 8, 2023. Accessed March 12, 2025.

- 2025 cell & gene state of the industry briefing: introduction and industry update. Alliance for Regenerative Medicine. Published January 14, 2025. Accessed February 28, 2025. https://www.youtube.com/watch?v=0RyH22zcsSw

- InspiroGene. 2024 Cell and gene therapy report: advancing the future of medicine. Published October 9, 2024. Accessed February 28, 2025. https://inspirogene.com/2024cgtreport

- Alliance for Regenerative Medicine. The sector snapshot: April 2023. Published April 2023. Accessed February 28, 2025. https://alliancerm.org/sector-snapshot/

- Wong CH, Li D, Wang N, Gruber J, Conti RM, Lo AW. Estimating the financial impact of gene therapy in the U.S. National Bureau of Economic Research. April 2021. Accessed March 5, 2025. https://www.nber.org/system/files/working_papers/w28628/w28628.pdf

- AbbVie and REGENXBIO announce updates on the ABBV-RGX-314 clinical program. News release. AbbVie. Published January 13, 2025. Accessed February 28, 2025.

- BlueRock Therapeutics advances investigational cell therapy bemdaneprocel for treating Parkinson’s disease to registrational phase III clinical trial. News release. BlueRock Therapeutics. Published January 13, 2025. Accessed February 28, 2025.

- Mast, J, Herper, M. As researchers push for a type 1 diabetes cure, Sana Biotechnology provides a nudge forward. STAT. Published January 16, 2025. Accessed February 28, 2025. https://www.statnews.com/2025/01/16/sana-bio-technology-stock-soars-on-diabetes-treatment-insulin-producing-cell-implants/

- Srivastava S. Time to start clearing bottlenecks in cell and gene therapies. Cell & Gene. Published May 5, 2021. Accessed March 13, 2025.

- Moreira, L. Cell and gene therapies’ evolving temperature-controlled requirements call for specialized logistics solutions. BiopharmaDive. Published September 13, 2021. Accessed February 28, 2025. https://www.biopharmadive.com/spons/cell-and-gene-therapies-evolving-temperature-controlled-requirements-call/605732/

- America Counts Staff. What is rural America? US Census Bureau. Published August 9, 2017. Accessed February 28, 2025. https://www.census.gov/library/stories/2017/08/rural-america.html

- Ahmed N, Karmali R, Nath R, et al. Chimeric antigen receptor T-cell access in patients with relapsed/refractory large B-cell lymphoma: association of access with social determinants of health and travel time to treatment centers. Transplant Cell Ther. 2024;30(4):190-198. doi:10.1016/j.jtct.2024.04.017.

- Rotz G, Punj S, Harve R, Tam A, Pezzack B, Kustermans C. From hype to reality: how to succeed in the cell and gene therapy market. PwC. Published January 2023. Accessed February 28, 2025. https://www.pwc.com/us/en/health-industries/pharma-life-sciences/assets/cell-gene-therapy-pwc-pharma.pdf

- CMS enters agreement with Vertex, bluebird to improve access to gene therapies. Reuters. Updated December 4, 2024. Accessed February 28, 2025. https://www.reuters.com/business/healthcare-pharmaceuticals/cms-enters-agreement-with-vertex-bluebird-improve-access-gene-therapies-2024-12-04/